Would like to know more information about how the marketplace does in terms of taxes & fees. I know it takes commission from sellers sales, does it charge a customer at checkout process a “processing / Order fee”? and also how do taxes work, are the sellers given a tax system in their profile to monitor and track their sales + taxes. Does Gameflip charge tax on all transactions? How does marketplace taxes differ from regular e-commerce sites for example amazon, ebay, etc. because I’ve seen those sites have taxes at checkout.

So, every sale you make, Gameflip take a commission and digital transfer fee. You can get choose to pay $1 a month so you get no fees on your sales for a month, up to a $50 max sale. Go to Wallet > Subscription.

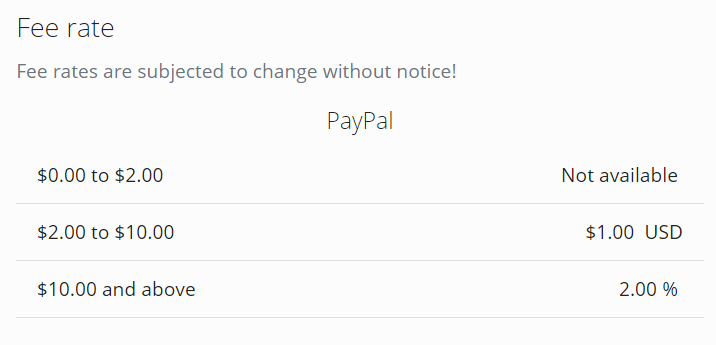

If you want to withdraw, this is why I never like it.

Gameflip do take a fee from your cash, depending on the amount you withdraw. When it reaches PayPal (should be seconds), they also take a fee, depending on the amount. If you’re wanting to use other payment methods such as Payoneer and BitCoin, I am not sure about their fees.

Let me know if you have any another questions.

I already know all this im asking about taxes. Does this marketplace charge customers taxes at checkout, how do they pay business taxes on marketplaces? I’m trying to learn about marketplaces and business of them, and main thing I can’t figure out is taxes.

Well, apart from the fees to pay, there isn’t ‘taxes’ as such to pay on here. You only get fees.

For local/state taxes, you have to keep track and file them on your own.

right so the sellers file on their own, but how does the marketplace itself do taxes? Like how can you calculate profits earned from buyers / sellers per transaction and tax it. do you go about charging the sales tax that the business is in or like charge income tax, im confused on how marketplaces such as gameflip, and other sites handle taxes if they don’t charge tax at checkout.

I’m now confused by what you mean, Gameflip would pay their taxes from the fees we pay.

right but what im saying is the % they take from seller comission + the money they charge buyer at checkout for “order fee”, do they pay a sales tax for that amount earned? or is it total income based tax? How would they calculate the tax is what im saying. They are based in California.

No seller or buyer pays tax in here. However, you can file tax with proof of how much you get/spend on the site

You’re confusing me, I don’t know how they calculate their tax, you would have to contact them.